(New York=Yonhap Infomax) Jin Woo Choi—The US dollar weakened as disappointing private employment data weighed on the greenback, overshadowing optimism over a potential end to the US federal government shutdown.

The British pound underperformed the dollar, pressured by UK unemployment hitting its highest level in four years and seven months.

According to Yonhap Infomax (screen number 6411), as of 16:00 on the 11th (US Eastern Time), the dollar-yen exchange rate stood at 154.126 yen, up 0.096 yen (0.062%) from the previous New York close of 154.030 yen.

The euro-dollar rate was $1.15834, up $0.00195 (0.169%) from the previous session.

Frank Elderson, Executive Board Member of the European Central Bank (ECB), stated, "The risks of inflation coming in higher or lower than expected are balanced." He added, "Recent developments are relatively positive, and some of the risks we were concerned about are gradually receding."

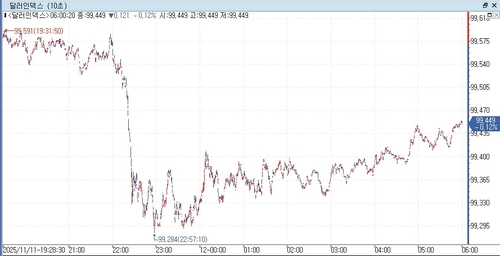

The dollar index (DXY), which tracks the greenback against six major currencies, fell 0.116 points (0.117%) to 99.453 from the previous session.

The dollar came under pressure in New York trading following weak private employment data. According to ADP, a US private payrolls firm, preliminary figures showed US private employment fell by an average of 11,250 jobs per week over the four weeks ending October 25.

This contrasts with ADP's monthly National Employment Report (NER) released last week, which showed private payrolls rose by 42,000 in October from the previous month.

ADP commented, "The data suggests job creation remained challenging in the latter half of October," adding, "Among market participants, there is a growing perception that employment growth will slow for an extended period due to declining labor demand and persistent labor shortages."

The dollar index briefly dropped to as low as 99.284 during the session, reflecting expectations for a Federal Reserve rate cut.

Meanwhile, the US government shutdown appears set to end. The House of Representatives is scheduled to vote on the Republican interim budget bill, which passed the Senate, on the 12th. With Republicans holding a majority in the House, passage is likely. Once President Donald Trump signs the bill, the shutdown will officially conclude.

Sam Stovall, Chief Investment Strategist at CFRA, said, "The market expects the shutdown to end. People will return to work, economic data will be released again, and uncertainty will recede."

Marc Chandler, Chief Market Strategist at Bannockburn Forex, noted, "Once the government reopens, we will start to see cracks emerge in various areas. The fundamental investment sentiment toward the dollar remains negative."

The pound-dollar rate fell $0.00199 (0.151%) to $1.31614 from the previous session.

According to the UK Office for National Statistics (ONS), the unemployment rate for July–September was 5.0%, above the market forecast of 4.9% and the highest since four years and seven months ago.

Sanjay Raja, Chief UK Economist at Deutsche Bank, assessed, "Today's data will give the Bank of England the confidence to cut policy rates further by year-end."

The offshore dollar-yuan (CNH) rate rose 0.0007 yuan (0.010%) to 7.1220 yuan from the previous session.

jwchoi@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.