(New York=Yonhap Infomax) Jin Woo Choi—The US dollar posted a modest gain.

Risk aversion eased during the session, as a series of hawkish remarks from senior Federal Reserve officials dampened expectations for a policy rate cut.

The British pound came under pressure due to fiscal concerns after the UK government abandoned plans to raise income taxes. The Taiwan dollar surged sharply after the US and Taiwan reached an agreement not to manipulate exchange rates.

According to Yonhap Infomax (screen number 6411), as of 16:00 on the 14th (US Eastern Time), the dollar-yen exchange rate stood at 154.528 yen, down 0.014 yen (0.009%) from the previous New York close of 154.542 yen.

The euro-dollar rate fell 0.00120 dollars (0.103%) to 1.16211 dollars from the previous session.

Germany’s Bundestag Budget Committee approved a government budget plan for new borrowing totaling 180 billion euros (about 304.3 trillion won) for 2026, according to German public broadcaster Deutsche Welle (DW). This marks the second-largest new borrowing in history.

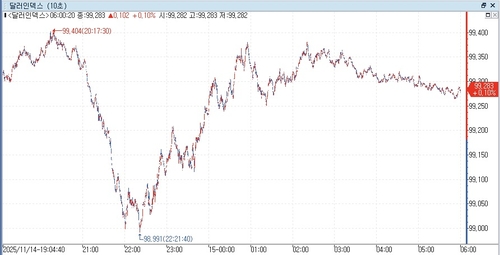

The dollar index (DXY), which measures the greenback against six major currencies, rose 0.097 points (0.098%) to 99.278 from the previous session.

The dollar briefly dipped below 99 at the start of the New York session as risk aversion intensified.

However, sentiment reversed as hawkish comments from senior Fed officials came into focus, pushing US Treasury yields higher and strengthening the dollar.

The tech-heavy Nasdaq Composite Index climbed as much as 0.89% intraday.

Phil Blancato, CEO of Ladenburg Thalmann Asset Management, said expectations for strong earnings from Nvidia are reinforcing the case for bargain hunting.

Jeffrey Schmid, President of the Federal Reserve Bank of Kansas City, stated, “We cannot afford to be complacent. Persistent inflation could alter price-setting psychology and risk entrenching inflation.”

Lorie Logan, President of the Federal Reserve Bank of Dallas, said, “Unless there is compelling evidence that inflation is coming down much faster than I expect, or the labor market cools more markedly than its current gradual pace, it will be difficult to support another rate cut.”

The dollar index reflected these developments, rising as high as 99.380 during the session.

Bank of America (BofA) noted in a report, “With the resumption of US data releases, rate differential volatility is likely to intensify.”

The pound-dollar rate fell 0.00175 dollars (0.133%) to 1.31681 dollars from the previous session.

The Financial Times (FT) reported that Chancellor Rachel Reeves had previously signaled an income tax hike but has now scrapped the plan.

With expectations for income tax hikes to fill fiscal gaps fading, UK government bond yields surged and the pound came under downward pressure. The pound-dollar rate fell as low as 1.31230 dollars during the New York session.

Maxime Darmet, Chief Economist at Allianz Trade, commented, “Relying on spending cuts and higher taxes for high-income and wealthy individuals, rather than an income tax hike, could limit revenue and is unlikely to convince bond investors.”

The dollar-Swiss franc rate rose 0.0009 francs (0.113%) to 0.7939 francs from the previous session.

The US lowered tariffs on Swiss products from 39% to 15%. In return, Swiss companies agreed to invest $200 billion in the US by 2028.

The offshore dollar-yuan (CNH) rate rose 0.0026 yuan (0.037%) to 7.1006 yuan from the previous session.

The dollar-Taiwan dollar rate plunged 0.2950 Taiwan dollars (0.949%) to 30.792 Taiwan dollars.

The US Treasury and Taiwan’s central bank announced, “Both sides will refrain from artificially manipulating exchange rates or the international monetary system to impede balance of payments adjustments or gain unfair trade or competitive advantages.”

jwchoi@yna.co.kr

(End)

Copyright © Yonhap Infomax Unauthorized reproduction and redistribution prohibited.